Double declining balance method formula

It is defined by the equation Monthly Payment P r1rn1rn-1. The double declining balance method is simply a declining balance method in which double 200 of the straight line depreciation rate is used.

Double Declining Balance Method Of Depreciation Accounting Corner

This guide will explain.

. What is the Double Declining Balance Depreciation Method. GDS using 150 declining balance. The other methods listed also use EMI to calculate the monthly payment.

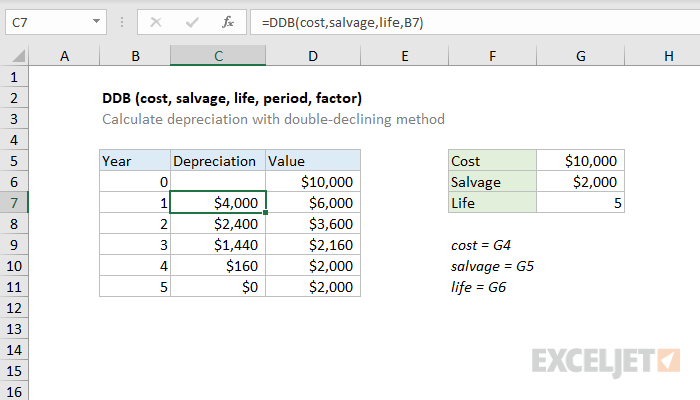

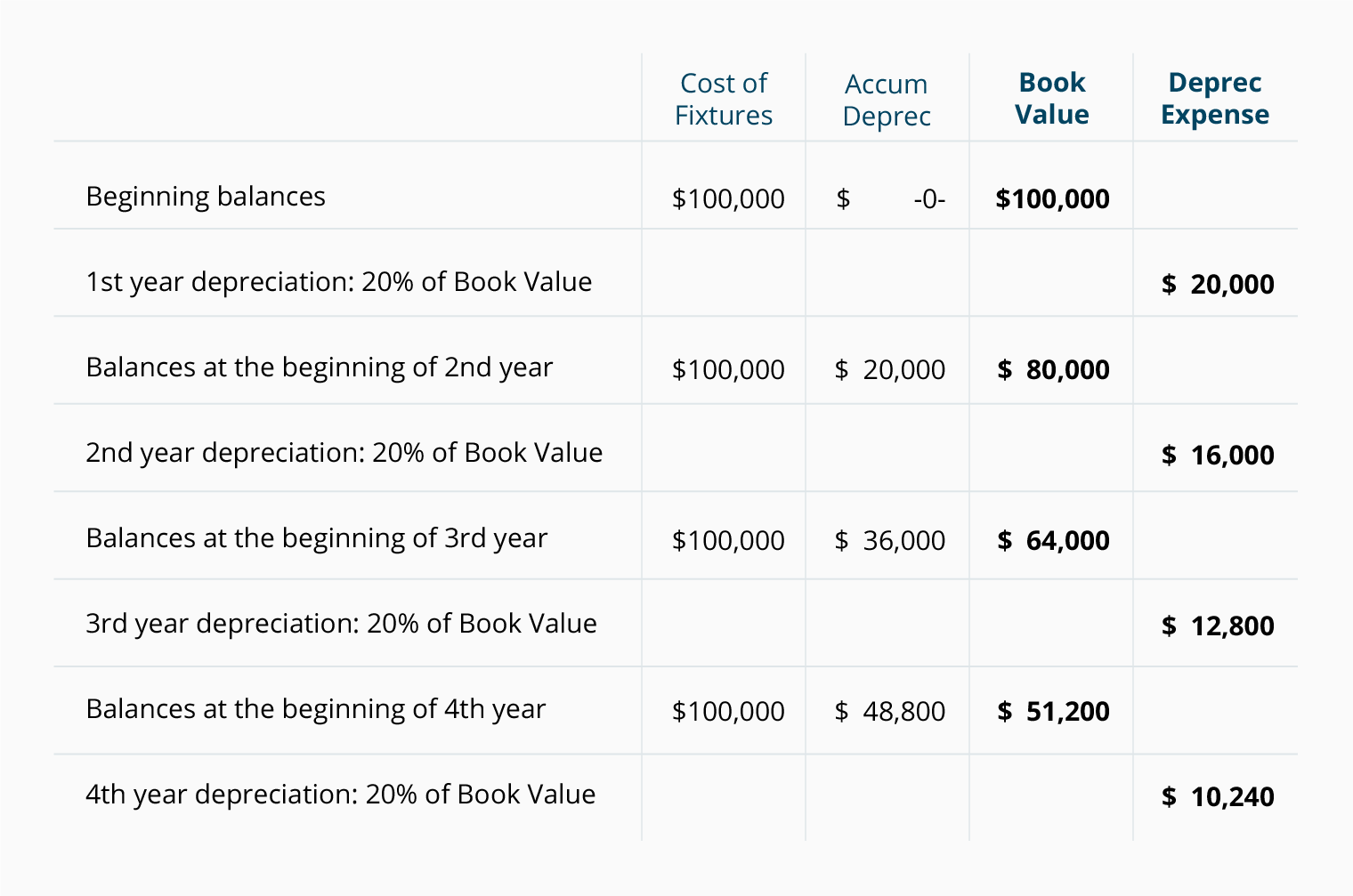

This is one of the two common methods a company uses to account for the expenses of a fixed asset. Asset cost salvage value useful life 10000 500 10 950. Excel uses a slightly different formula to calculate the deprecation value for the first and last period the last period represents an 11th year with only 3 months.

If we use Straight. It is frequently used to depreciate fixed assets more heavily in the early years which allows the company to defer income taxes to later years. More Straight Line Basis Calculation Explained With Example.

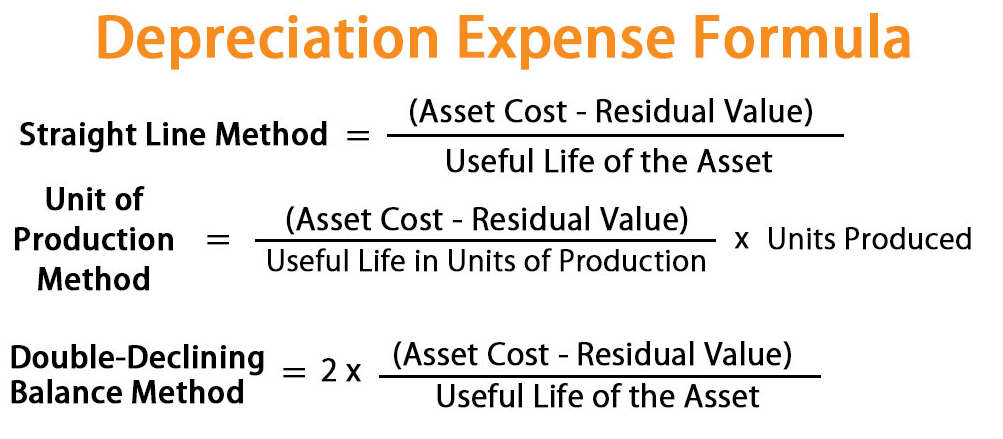

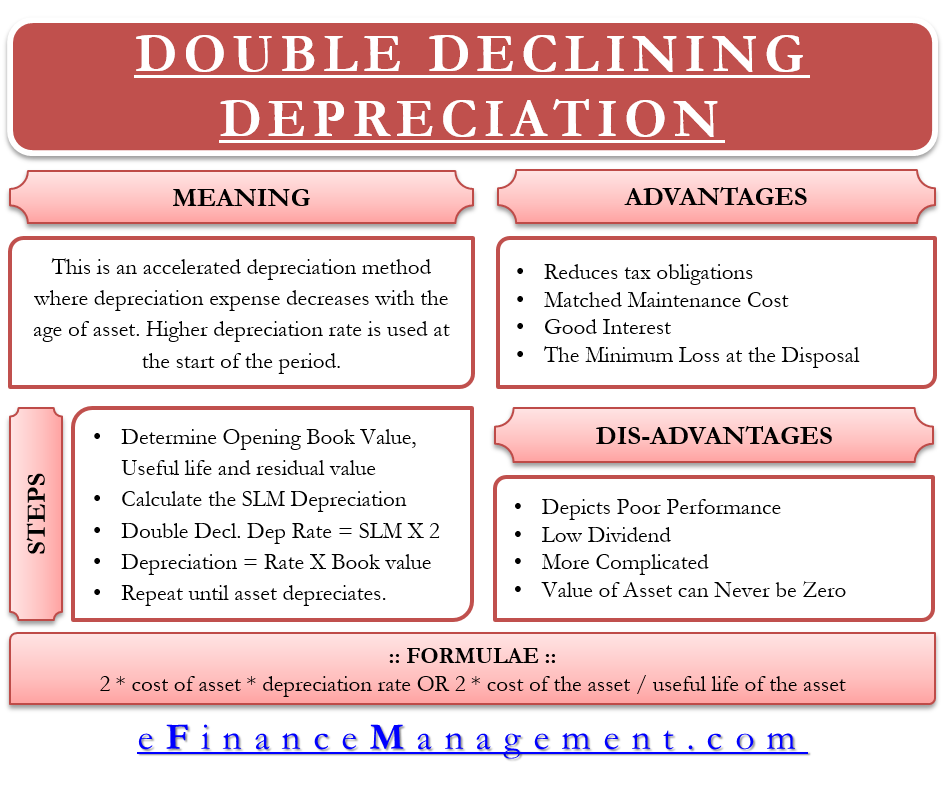

This tax depreciation method uses the straight-line formula under the GDS that calculates an even depreciation amount over the assets life with the exception of the. This is an accelerated depreciation method. Unit of production method if the machinery produces 16000 units in year 1 and 20000 units in year 2.

The boolean value TRUE as the last. The double declining balance depreciation method is a form of accelerated depreciation that doubles the regular depreciation approach. The VDB variable declining balance function is a more general depreciation formula that can be used for switching to straight-line see below.

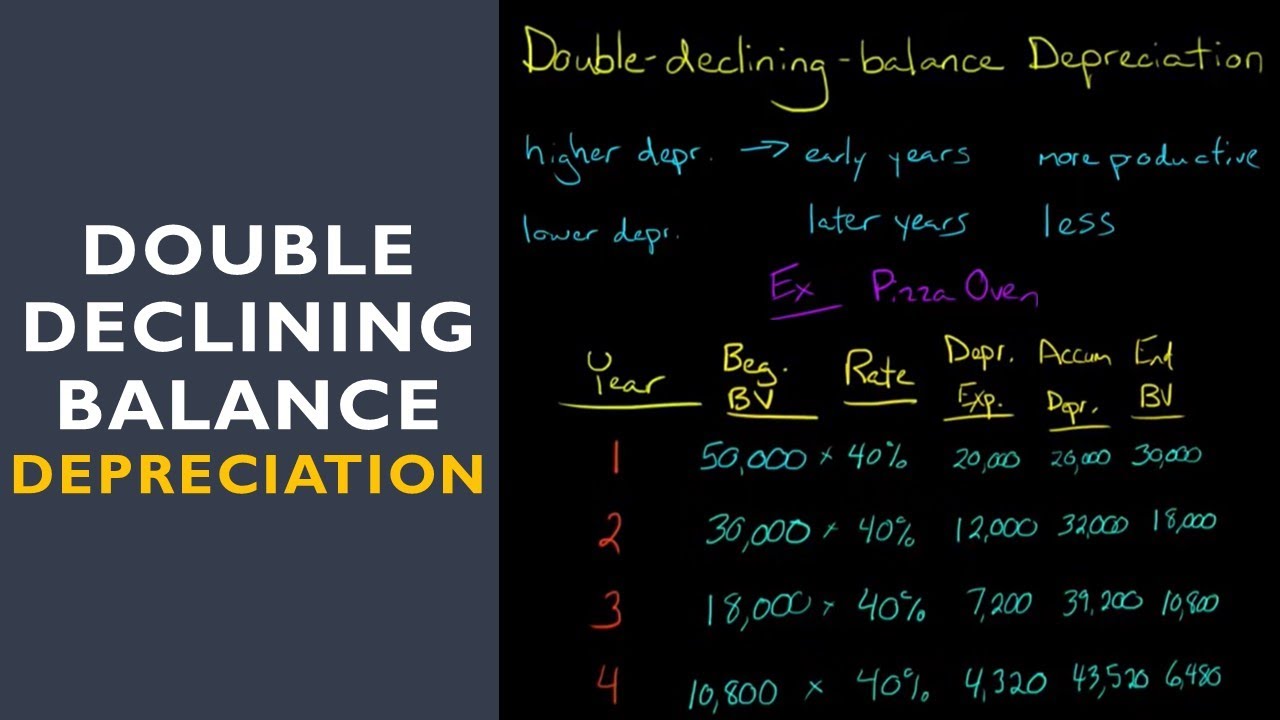

Depreciation Asset Cost Residual Value Useful Life of the Asset. This depreciation method gives you a higher depreciation rate 150 more than the straight-line method. This method is commonly called the Double-Declining Balance Method because the depreciation rate that is used is usually double the straight-line rate or d2n.

The equation to find the monthly payment for an installment loan is called the Equal Monthly Installment EMI formula. The double declining balance depreciation method is one of two common methods a business uses to account for the expense of a long-lived asset. Double declining balance method.

The double-declining balance method is a slightly more complicated way to depreciate an asset. We still have 167772 - 1000 see first picture bottom half to depreciate. The DDB Double Declining Balance function is easy again.

The double-declining balance DDB depreciation method is an accelerated method that multiplies an assets value by a depreciation rate. In these situations the declining balance method tends to be more accurate than the straight-line method at reflecting book value each year. The first step in declining balance method is to calculate a straight line depreciation rate that is calculated using the following.

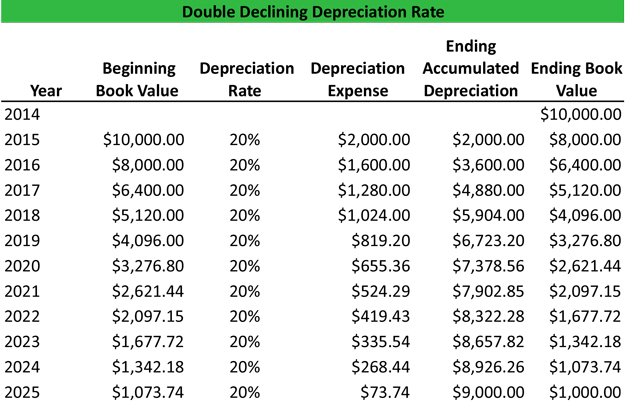

Double Declining Balance Depreciation Method. Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice the value of. GDS using straight-line method.

Also discussed in the first paragraph of the article. Depreciation is calculated using the formula given below. The basic formula to calculate depreciation using the double-declining method is Declining Balance Method Example An asset worth 10000 has a life of 5 years and its salvage value is 0 after five years.

So youll write off 950 from the bouncy castles value each year for 10 years. 3 Double declining method. It lets you write off more of.

As the name suggests it counts expense twice as much as the book value of.

Double Declining Balance Method Of Deprecitiation Formula Examples

Double Declining Balance Method Prepnuggets

How To Use The Excel Ddb Function Exceljet

Double Declining Balance Depreciation Daily Business

Declining Balance Depreciation Double Entry Bookkeeping

Double Declining Balance Depreciation Method Youtube

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Balance Depreciation Fundamentals Of Engineering Economics Youtube

Double Declining Balance Depreciation Calculator

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

Simple Tutorial Double Declining Balance Method Youtube

Double Declining Balance Method Of Depreciation Accounting Corner

What Is The Double Declining Balance Ddb Method Of Depreciation

What Is The Double Declining Balance Method Definition Meaning Example

Double Declining Depreciation Efinancemanagement

Depreciation Formula Examples With Excel Template

Depreciation Units Of Activity Double Declining Balance Ddb Sum Of The Years Digits Accountingcoach